While most collectors enjoy gathering their favorite players in cardboard form, more and more are considering sports cards as an alternative investment, and a lucrative one at that.

Take the 1986 Fleer Michael Jordan rookie card for example. In 2020 this basketball card yielded an astronomical 21,000% ROI. Now don’t rush to eBay and buy every MJ rookie card but we do suggest allocating 5 to 10% of your investment portfolio to sports/trading cards.

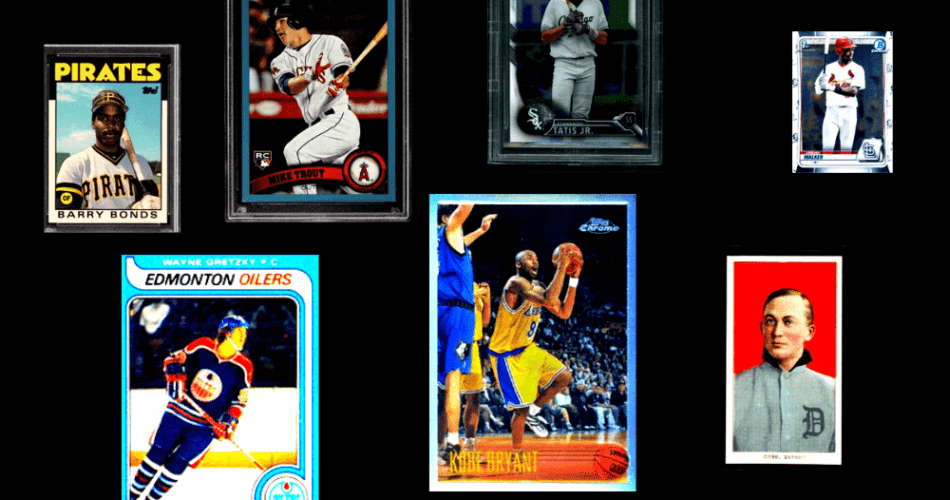

To help you maximize your return and pull those massive profits, here are 10 tips to consider when investing in sports cards.

Trending: Greatest Lebron James Rookie Cards of All Time

99.99% of cards are NOT worth buying

Remember this. Tattoo it to your forehead if you must. Please live by this rule. Only buy the 1% of cards that we recommend. For example, Ty Cobb T206 Red or Greenback is ALWAYS a good buy. Currently, Joe Burrow and Trevor Lawrence ar MUST haves but this can change during the course of the season.

The best advice we can give is to bookmark this site and check it often for buying advice.

Diversify, Diversify, and Diversify Some More

We’ve all heard about the dangers of keeping all eggs in one basket, and it applies to sports card investing. While collecting one player is great for a personal collection, it’s a substantially riskier way to invest; a freak accident, a career-ending injury, or a scandal so severe it could ruin a reputation are all possibilities that, doubtful as they may be, have to be considered when investing in an athlete. You might’ve been the guy with the foresight to buy up every card of the unknown Giannis Antetokounmpo back in 2013, but you could’ve also been the guy who hoarded that season’s top draft pick, Anthony Bennett.

Like in any professional league, picking the right rookies can lead to substantial rewards. Similarly, there are dozens of “flops” for every one star; even if a player sticks around the league and fills a role on a team, it doesn’t make their cards a profitable purchase. When approaching your collection as an investment, diversification is key.

Let’s say you were the guy who collected Bennett in 2013, but that he wasn’t the only player you decided to invest in; you also purchased some of that season’s long-time stars, like Kobe Bryant or LeBron James. While it’s unfortunate that your buys of Anthony Bennett become losses, you had a diverse player portfolio and your purchases of Kobe and LeBron have brought you profits over your Bennett losses. Maintaining a balance between unproven rookies, current stars, and league legends is the most effective and safest way to work toward those massive profits we all want.

Rookies

This may seem contradictory since I just recommended buying a mix of rookies and stars, but you should almost always lean in favor of buying rookie cards. You should still be diversifying your portfolio with some of the tested veterans, but you should be focusing on their rookie cards.

LeBron James has been in the NBA for more than half of his life at this point. That means the man has his image on a lot of cardboard (twenty seasons’ worth as of this year). According to Trading Card Database, there are nearly 17,000 LeBron cards, accounting for multiple sets per season and multiple parallels and inserts in many of them. He may be one of the few players in the “Greatest of All Time” debate, but even that won’t bring substantial value to most of those cards.

In general, collectors want rookie cards. That little badge symbolizing a player’s rookie status boosts the worth of a card significantly, and across the board, a player’s rookie cards stand among their most valuable. As always, there are exceptions to the rule; while LeBron’s 2003 Topps Chrome or Exquisite RPA will remain as some of his priciest options, there are still many desirable cards from beyond his rookie seasons such as his 2012 Prizm – the set’s first year in production – or desirable inserts like Kaboom! or Downtown. Additionally, cards with that fabled One of One label will be worth a pretty penny regardless of the year they’re from.

Investment Style

We’ve established the importance of having a diverse portfolio of players, but what should that diversification look like numerically? The allocation will vary from person to person, as it depends on your investment goals.

- Ultra-Conservative: 90% HoF/HoF Active|10% HoF Potential|0% Rookies/ProspectsFor those who don’t mind taking smaller profit margins to minimize risk, an ultra-conservative approach is a strong choice. While we’ve previously discussed splashing in a few unproven rookies into your portfolio in the hopes one develops into a legendary all-star, it’s still possible none will. In this allocation, an investor would focus on players who have already established themselves as some of the biggest names in the history of their sport. These players either already are or have guaranteed themselves a spot in the Hall of Fame. Though avoiding new rookies and prospects altogether, this allocation still takes risk of greater gains in the form of players with HoF potential.

- Conservative: 70% HoF/HoF Active|20% HoF Potential|10% Rookies/ProspectsOnce more approaching investment with a low level of risk, the conservative allocation still focuses on established players but opts to take more chances than the ultra-conservative version. Reducing its investment in HoF/Active players, more attention is given to those with the potential to enter the Hall of Fame. More noteworthy is the decision to dip into rookies and prospects to make some high returns in the long term.

- Moderate: 60% HoF/HoF Active|30% HoF Potential|10% Rookies/ProspectsAs we continue to look for higher returns on our investment, we’ve shifted another 10% from HoF/Active over to potential HoF players. Those already in or guaranteed will naturally have higher price points than those who aren’t quite shoe-ins. As long as we pick smart, we stand to make more profit from smaller purchases this way. Still, we acknowledge that too much risk might not be for us, and leave our investment in rookies and prospects at 10%.

- Aggressive: 60% HoF/HoF Active|20% HoF Potential|20% Rookies/ProspectsTaking a more aggressive approach to our portfolio allocation leads us to give more attention to rookies and prospects. Some of these players won’t make a lasting impression on the game, but a few of them might end with Hall of Fame careers – and we’ll have invested in them for pennies on the dollar. Knowing it’s unlikely all of these prospects will be profitable, we maintain our majority in HoF/Active players for smaller but still steady gains on our investment.

- Ultra-Aggressive: 50% HoF/HoF Active|25% HoF Potential|25% Rookies/ProspectsWith this allocation, we’re taking on quite a bit of risk with our investment. However, we stand to make truly massive returns if our picks pan out. Our investment is split evenly between those in the Hall of Fame and those not, but with the 25% investment in potential HoF players we should still expect to see some gains even if our prospects don’t meet our expectations or hopes, using the HoF/Active investments to balance it out.

Risk Tolerance

Now that we’ve laid out various levels of allocation, it’s clear that there’s always some risk present when it comes to investing whether in stocks or cardboard. With those approaches in mind, this is a simple but significant step. Ask yourself how tolerant you are to the risk inherent with investing, and identify which one fits your situation best.

If you’re frozen by the thought of seeing your investment suffer even in the slightest downturn, it’s probably more prudent to go with an ultra-conservative allocation. If you’re a free spirit who likes to see where the chips fall, you’ll likely feel more comfortable taking a riskier approach and setting an ultra-aggressive allocation. Most of us will probably fall somewhere in the middle, taking a more moderate approach to balance our risk and returns.

Time Horizon

While many of us may have started collecting in our childhoods, it may have been much later in life that we began treating our collections as investments. It’s wise to consider your time horizon when making your purchases and setting your allocations.

If you’re in your sixties, you’re likely at or approaching the point where you’ll cash out some of your investments to support yourself in your golden years. You may want some low-risk investments from Hall of Famers for later on, but you’ll probably want most of your purchases at this point to be focused on maximizing returns in a short time which means setting a high allocation for rookies and prospects.

On the other hand, if you’re in your twenties you have a lot of time to sit on your investments. Allocating a higher portion of your collection to HoF/Active players may leave you with smaller gains in the immediate future, but the steady growth will leave you with big rewards as you hold them years or decades into the future.

When to Buy

Though you can hop on eBay and buy a card anytime you want, there are times you should avoid it. Good times to buy are constantly changing and affected by sport, season, and player.

Generally, the offseason is a good time to buy cards for your collection. The sport isn’t actively in the media cycle, meaning many active players aren’t top of mind. As the season approaches and excitement builds, prices will likely increase. Players with high expectations will see the most growth, with those flying under the radar available for some steals.

A similar wave of hype will approach during the postseason. Favorites for the title of champion will see a spike in value, but players whose teams have failed to secure a playoff position will often drop. It can be an opportune moment to buy into those players as many collectors will sell them off out of disappointment, but fewer collectors will be interested in buying them.

Sometimes, a player will make their name known in a random game. This one great performance can send collectors clamoring for a piece of their cardboard stock despite hearing about them for the first time. You should seldom buy into a player this way.

Take Cooper Rush as an example. After Dak Prescott’s injury, Rush stepped in as the Cowboys’ starting quarterback. Though he performed well over an extended stretch, almost everyone knew Dak would continue to start upon his return. Still, Rush’s card prices exploded while he manned the helm. When Dak resumed play, Rush’s prices dropped just as quickly. They’re still well above the price point before he took over, but anyone buying at the height of the hype saw huge losses.

When focusing on players who have already retired from their league, the purchase window is much wider. In or out of season, Hall of Famers tend to stay fairly steady – a key reason why they’re such a big part of our portfolio allocation. Because their legend in the sport has already been cemented, they don’t face the same fluctuations in price that come with active players. They can still fall or rise in value in response to news of a scandal or significant development, but overall the only time to particularly avoid is around a sport’s Hall of Fame enshrinement as legends will be on the minds of more collectors.

When To Sell

Essentially, take the guidance for buying and flip it around: hold most cards during the offseason, consider selling into the hype surrounding the start of the season and postseason, and if you have cards of a player experiencing a hype-game surge, sell, sell, sell.

Some other points of note include trade rumors, which you should sell into if the destination is favorable or their role will be more significant there, and the initial release of card sets, which you should sell while people scavenge eBay for the quickest PSA 10 submissions. Likewise, you should generally avoid buying at these points.

Where To Sell

When an opportunity presents itself to turn one of your card investments into actual gains, you need to consider your selling options. There are options to do so in person and online, each with its pros and cons.

- Online:For many sellers, eBay is the most convenient method. Simply post your card in an auction format or at a set price, and wait for your buyer to find it. You can use eBay’s ad tools to signal to boost your listing and attract more potential buyers for a percentage of the final sale price, allowing you to move the item faster. You can also include an option for potential buyers to make an offer, allowing you to meet them somewhere in the middle to make the sale. Though a buyer must pay immediately for any of your set price listings, they have a few days to provide payment after a winning auction. This can cause headaches if they decide they don’t actually want to pay, leaving you with your card but requiring you to create a new listing to sell it. Still, even with its flaws eBay’s ease of use makes it an attractive sales hub.Other online options include StockX, COMC, and Whatnot, each designed to get your card into a buyer’s hands. The shipping costs, whether covered by the buyer or seller, will eat into your profits a bit (or a lot if selling a lower-end card) which may turn some sellers towards doing business in person. Additionally, the requirement of safe delivery of the item may discourage sellers from taking on more risk, also pushing them to seek in-person options. Even so, when in need of a quick sale that still has security, online may be the route for you.

- In-Person:If you’re under less pressure to move an item, waiting for a chance to do so in person may better suit you. Across the US, many cities organize regular or semi-regular card shows; these are some of the best opportunities to move your cards, in-person or online. Ranging from a handful of tables to hundreds of them, these shows can be packed with any and every level of card value. While it’s possible to simply show up, pay the admission fee, and sell your cards to someone inside, you’ll typically have more success (though more investment cost) renting a table, or multiple if you have a lot of inventory. If you only have a single card you’re trying to sell, pass it on the table and just talk to some of the vendors while keeping an ear out for the buyers around you. The card shows, whether at a table or walking around, provide the safety of an in-person transaction, allowing you to avoid the risk of your package being damaged in transit or lost altogether. The buyer also gets to examine the card in hand, meaning deals are final and free of any guilt.If the cost of a table at a show is too much, there are still alternative ways to move your cards without shipping. You can list your card on Facebook Marketplace or OfferUp, but set up an in-person meeting for the actual transfer of the card – just be sure to do so at a safe location! You could also take your cards to a pawn shop, many of which will deal with cards, but almost none of which will provide you with close to the full value; this should be avoided, but if you find yourself in a major pinch it might be worth it.

Track Your Investment

If you want to make massive profits from your sports card investments, you need to be able to track said profits. The process may be more time-consuming than obtaining your cards, but it’s a key step; if you can’t recall the price you bought in at, how could you make a confident call to sell?

The simplest method would be to make a spreadsheet and update it as you do your portfolio. When you buy a new card, add it to the spreadsheet along with the price paid and the date purchased. When you sell the card down the road, once again record its sale price and the date of the transaction. From there you can record information in your other columns such as return on investment, in currency and/or percentage, and time held before sale; these two pieces of information will be particularly important when addressing your annual taxes.

Collect Your Love

This last tip may sound overly sentimental, but it’s tried and true in not only the hobby but any others where collecting is present. We’ve discussed much risk and how it’s nearly unavoidable within sports card investing, and even in this approach it’s still present through reputation changes.

But when it comes down to it, there’s no better way to minimize your risk than collecting the things you love. If you’re fortunate you’ll love to collect Tom Brady or Leo Messi, and you’ll still hold the potential for some financially solid gains with your investments. Maybe you’re a fan of Boban Marjanović or Johnny Manzel, instead; you likely won’t see massive profits off their cards, but there’s a personal value to collecting your fandom that’s still significant.

Even with less popular players, there’s still a market; someone is buying Boban, after all. You can focus on collecting your team, including the players who aren’t and will never be superstars, and with enough patience, you can find a buyer for any of them – even if it’s just a fellow team collector. The best part about collecting what you love is that, even if the stars don’t align to match you with that buyer, you’ll still have a card in your collection that you’re glad to have. The value of your investment will never reach zero so long as you’re happy to keep it.

The End… You Win.

It’s critical to remember that no investment is guaranteed to profit, but that you can always take steps to maximize your chances. By following these tips, you stand a great chance to see massive returns on your sports card investments, and hopefully set yourself up to enjoy your journey through the hobby along the way.